History of Mortgage Rates - Are Mortgage Rates Good Right Now?:

The landscape of homeownership in the United States has evolved significantly over the past century. From a luxury afforded only by the affluent to a cornerstone of the American Dream, the journey of homeownership has been closely intertwined with the development of mortgage financing. Central to this evolution has been the trajectory of mortgage interest rates, particularly those of the 30-year fixed-rate mortgage. Understanding the historical context of mortgage rates can provide invaluable insights for prospective homebuyers navigating the housing market and help answer the question: are mortgage rates good right now?

The Emergence of the 30-Year Fixed-Rate Mortgage:

The genesis of widespread homeownership can be traced back to the Great Depression era and the subsequent post-World War II period. The establishment of the Federal Housing Administration (FHA) in 1934 paved the way for the 30-year fixed-rate mortgage, transforming homeownership from a distant aspiration to an achievable reality for millions of Americans. This innovative financing mechanism allowed individuals to purchase homes on an installment plan, solidifying homeownership as a fundamental component of the American Dream.

Mortgage Rate Trends Over the Decades:

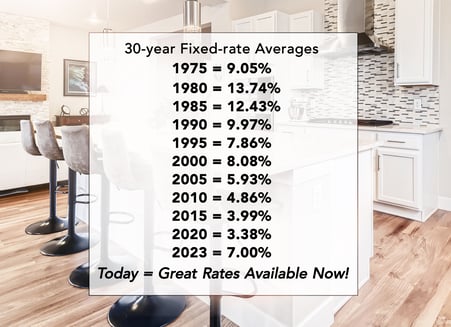

The journey of mortgage interest rates over the past five decades reflects the dynamic interplay of economic forces, policy interventions, and market trends.

1970s: The decade began with 1970’s mortgage rates hovering around 7.3 percent in 1971, escalating to a staggering 12.9 percent by 1979. The era was characterized by the Federal Reserve's expansionary policies and inflationary pressures, driving borrowing costs upwards.

1980s: Mortgage rates in the 1980’s witnessed unprecedented volatility in, culminating in a peak of 18.4 percent in October 1981. The era of the Great Inflation exerted significant upward pressure on borrowing costs, although rates eventually moderated to around 9.78 percent by the decade's end.

1990s: A dramatic shift occurred in the 1990s, with mortgage rates plummeting to an average of 6.91 percent by 1998. The dot-com bubble and subsequent flight to fixed-income investments contributed to this decline, signaling a new era of affordability for homebuyers.

2000s: The latter half of the 2000s saw mortgage rates experiencing another downward trajectory, facilitated by the housing market crash and subsequent quantitative easing measures by the Federal Reserve. Rates dropped from around 8 percent at the decade's onset to approximately 5.4 percent by 2009.

2010s: Mortgage rates continued their downward trend throughout the 2010s, dipping below the 4 percent mark and ending the decade in a relatively moderate range. The Federal Reserve's bond-buying activities played a pivotal role in shaping this trajectory.

2020s: The onset of the 2020s witnessed historically low mortgage rates, with the 30-year fixed rate plunging to just under 3 percent amid the COVID-19 pandemic. However, subsequent efforts by the Federal Reserve to curb inflation led to a reversal, with rates peaking above 8 percent in late 2023.

Impact on Homebuyers:

The current mortgage rate landscape presents favorable conditions for homebuyers compared to previous decades. Lower rates translate to increased affordability and buying power, enabling more individuals to achieve homeownership. Factors such as creditworthiness and down payment size continue to influence the accessibility of favorable rates.

Conclusion:

Navigating the intricacies of mortgage interest rates requires an appreciation of historical trends and a nuanced understanding of market dynamics. While the trajectory of rates remains subject to economic fluctuations and policy shifts, informed decision-making can empower individuals to make prudent choices regarding homeownership. As the journey of homeownership continues to unfold, the saga of mortgage rates serves as a testament to the enduring pursuit of the American Dream.

Want to Know Today's Mortgage Rates or Learn about Mortgage Rate Incentives?

Contact us today!